Okay, let's dive into the world of prop firm trading and talk about the part everyone really cares about: getting paid! Specifically, we're looking at Apex Trader Funding payouts. If you're grinding away on the charts, passing evaluations, and finally trading a funded account, the big question looming is always, "How do I actually get my hands on the profits?"

You've probably heard of Apex Trader Funding – they're one of the biggest names in the prop firm game right now, known for frequent deep discount sales on their evaluations (often 80% or even 90% off!) and offering a wide range of account sizes, from $25,000 all the way up to $300,000, making them accessible for different trader levels. They offer traders the chance to manage significant capital after proving their skills in an evaluation. But passing the eval is just step one. Step two, and arguably the most exciting step, is successfully withdrawing your earnings.

There can be a bit of confusion or anxiety around Apex payouts, especially for new traders or those new to prop firms. Questions pop up all the time: Is it legit? How long does it take? Are there weird rules I need to know about? What system do they even use to send the money now?

Well, grab a coffee, settle in, because we're going to break down everything you need to know about Apex Trader Funding payouts in plain English. No confusing jargon, just the straight scoop. We'll cover the process, the current payout methods, the rules (yes, there are rules!), timelines, and tackle those nagging questions head-on.

Here’s what we'll cover:

Table of Contents

-

Quick Refresher: What's Apex Trader Funding Anyway? (Plus Sales & Sizes!)

-

The Million-Dollar Question: Why Payouts Are Everything

-

How Do Apex Payouts Actually Work? The Nuts and Bolts (Updated Methods!)

-

The Request Process

-

Payout Methods: Rise (International) & ACH (US) - The NEW Way

-

Eligibility: Ticking the Boxes

-

-

Show Me the Money! Payouts and Performance Split Percentages

-

The Famous 90/10 Split

-

That Sweet 100% Initial Payout

-

-

Tick-Tock: How Long Does Apex Trader Funding Take to Payout? (Refined Timeline)

-

Starting Small: What is the Minimum Withdrawal from Apex Trader Funding?

-

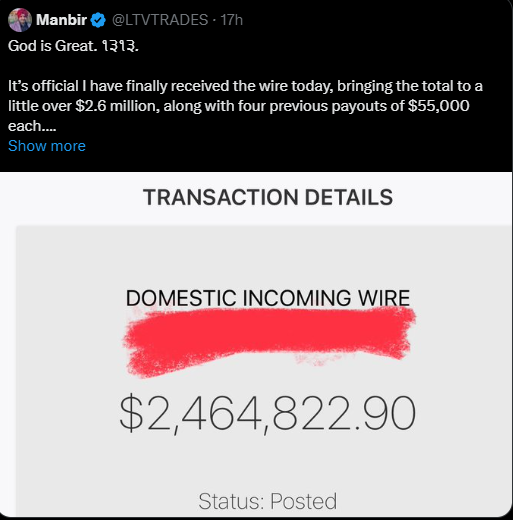

The Big Trust Question: Are Apex Payouts Legit? (Spoiler: Yes!)

-

Addressing the Skepticism

-

Apex's Own Payout Dashboard: Transparency FTW!

-

Real Trader Proof (Screenshots Coming!)

-

Community Buzz

-

-

Account Juggling: How Many Accounts Can You Have on Apex Trader Funding?

-

The 20-Account Max

-

Payouts Across Multiple Accounts

-

-

The Rule Everyone Asks About: What is the 30% Rule on Apex Payout? (Updated Rationale)

-

Decoding the Consistency Rule

-

Why Does It Exist? (Filtering Luck vs. Skill)

-

A Simple Example

-

-

Tips for Smooth Sailing: Getting Your Apex Payouts Without a Hitch

-

The Bottom Line: Is Getting Paid by Apex Realistic?

Let's get started!

1. Quick Refresher: What's Apex Trader Funding Anyway? (Plus Sales & Sizes!)

Before we dive deep into the apex trader payout process, let's quickly clarify what Apex Trader Funding is for anyone unfamiliar.

Apex is a "proprietary trading firm" or "prop firm." In simple terms:

-

You Prove Your Skills: You pay a fee to take an evaluation test (usually on a simulated account) where you need to hit specific profit targets without breaking certain rules (like maximum drawdown). Apex is famous for often running huge sales on these evaluation fees, sometimes up to 80% or 90% off, making it much more affordable to get started.

-

They Provide Capital: If you pass the evaluation, Apex gives you access to a funded account (called a Performance Account or PA account) with a substantial amount of virtual capital. They offer a great range of sizes, typically from $25k, $50k, $75k, $100k, $150k, $250k, up to $300k, catering to various trading styles and risk tolerances.

-

You Trade, You Earn: You trade this funded account according to their rules.

-

You Split the Profits: You keep a large percentage of the profits you generate (we'll get to the exact numbers soon!).

Essentially, they provide the funding, you provide the trading skill, and you both benefit from the profits. It allows talented traders to access much larger capital than they might have personally, dramatically increasing their earning potential.

2. The Million-Dollar Question: Why Payouts Are Everything

Let's be real. Trading simulators and hitting targets is great practice, but the entire point of trading with a prop firm like Apex is to eventually withdraw real money. The Apex Trader Funding payout is the ultimate goal. It's the validation that your strategy works, your discipline holds up, and you can translate simulated success into tangible income.

For many traders, receiving that first payout, no matter the size, is a huge milestone. It proves the concept, builds confidence, and fuels the motivation to keep going. Conversely, uncertainty or difficulties with payouts can be incredibly discouraging. That's why understanding this process inside and out is crucial.

3. How Do Apex Payouts Actually Work? The Nuts and Bolts (Updated Methods!)

Okay, let's get down to the practicalities. You've passed your evaluation, you're trading your PA account, and you've made some profit. How do you turn those screen dollars into real dollars using their current system?

The Request Process

This part remains largely the same:

-

Meet Eligibility: First, you need to make sure you meet all the criteria for a payout (more on this below). This usually involves things like minimum trading days and being above your initial balance plus the profit buffer.

-

Check the Payout Window: Apex typically has specific payout periods each month. Payout requests are usually processed twice a month. You need to submit your request during the designated request window. Check their website or your dashboard for the exact dates (usually around the 1st-5th and 15th-20th of the month, but always verify).

-

Submit via Dashboard: You'll log into your Apex Trader Funding dashboard. There will be a section dedicated to payouts. You'll select the account(s) you want to withdraw from and specify the amount.

-

Confirmation: You'll follow the steps, confirm your details, and submit the request.

Payout Methods: Rise (International) & ACH (US) - The NEW Way

This is a major update! As of recent changes (always verify current info on Apex's site!), Apex has discontinued using Deel and Wise for payouts. Here's how it works now:

-

For US Traders: Payouts are typically processed via Direct ACH Transfer to your US bank account. You'll need to provide your banking details (routing number, account number) securely through your Apex dashboard or their designated setup process.

-

For International Traders (Outside the US): Apex now utilizes a platform called Rise (sometimes referred to or involving Plane). International traders will likely receive an email prompting them to register an account with Rise to receive their payouts. Through Rise, you can then typically withdraw funds to your local bank account.

-

Setup is Key: Whether you're US-based or international, make sure you follow the instructions provided by Apex (usually via email or within your dashboard) to set up your payout method correctly and promptly once you become eligible or funded. Delays in setup can delay your payout.

-

Important Note: You are still responsible for any potential fees charged by intermediary banks or your own receiving bank. Rise might also have its own fee structure for withdrawals, which you should familiarize yourself with. Apex sends the approved amount, but net receipts can vary slightly based on these fees. Apex support generally cannot assist with issues specific to the Rise platform itself; you'd need to contact Rise support for that.

Eligibility: Ticking the Boxes

This remains critical. You can't just make $100 on day one and request a payout. Key eligibility requirements generally include:

-

Minimum Trading Days: You need to have actively traded (placed at least one trade) on a certain number of different days before being eligible for your first payout on a PA account. Historically, this has often been 10 trading days for the first withdrawal. Subsequent withdrawals usually have a lower minimum day requirement.

-

Profit Threshold: You need profits above your starting balance plus the required buffer/minimum withdrawal amount.

-

Consistency Rules: The 30% rule (discussed in detail later) must be met.

-

No Rule Violations: No breaches of drawdown limits or other core rules.

-

Request Window: Submission must be during the official window.

Always double-check the current, specific rules on the Apex website or in your member's area, as details can occasionally be updated.

4. Show Me the Money! Payouts and Performance Split Percentages

This is where Apex really shines and attracts a lot of traders. Their profit split structure is very generous.

The Famous 90/10 Split

Once you start taking payouts, the standard split is 90/10. This means you keep 90% of the profits you generate, and Apex keeps 10%. Compared to older prop firm models or hedge funds where splits might be 50/50 or worse for the trader, 90/10 is fantastic.

That Sweet 100% Initial Payout

Here's another huge perk: Apex lets you keep 100% of your first $25,000 in payouts per member. This isn't per account, but cumulative across all the accounts under your name.

-

Example:

-

You request a $5,000 payout from Account 1. You receive $5,000 (100%). You have $20,000 remaining of your 100% threshold.

-

You request another $6,000 from Account 2. You receive $6,000 (100%). You have $14,000 remaining.

-

You request $15,000 from Account 1. You receive $14,000 at 100%, and the remaining $1,000 is split 90/10, so you get $900 of that. Total received: $14,900. Your 100% threshold is now used up.

-

Any future payouts will be subject to the standard 90/10 split from the first dollar.

-

This 100% initial payout is a massive incentive and significantly speeds up recouping evaluation fees and building your trading bankroll.

5. Tick-Tock: How Long Does Apex Trader Funding Take to Payout? (Refined Timeline)

Okay, you've submitted your request during the window. Now the waiting game begins. How long does Apex Trader Funding take to payout?

Apex processes payout requests in batches after the request window closes. Their stated processing timeframe is generally within 5-7 business days after the request period ends.

-

Example: If the request window closes on the 20th of the month, they typically aim to process and send the payments out between the 21st and the 27th/28th (factoring out weekends/holidays).

What does this mean for total time?

-

Processing: 5-7 business days for Apex to approve and initiate the transfer (via ACH or to Rise).

-

Transfer Time:

-

ACH (US): Typically takes 1-3 business days to appear in your bank account after Apex sends it.

-

Rise (International): Time for funds to show in Rise, and then time for you to withdraw from Rise to your local bank can vary (could be a few extra days depending on Rise's process and your bank).

-

-

Total Estimated Time: So, realistically, from the end of the request window until the cash hits your personal bank account, you might be looking at roughly 7-9 business days total in many cases, maybe slightly longer for international transfers via Rise depending on their specific processing. It's often quicker than the old 10+ day estimates, but patience is still needed! Don't panic if it takes the full processing window plus transfer time.

6. Starting Small: What is the Minimum Withdrawal from Apex Trader Funding?

You don't need to make tens of thousands before you can take money out. Apex has minimum withdrawal amounts, but they are relatively reasonable.

The minimum withdrawal amount depends on the size of your PA account:

-

MINIMUM: The Minimum Payout for any size account is $500.

This means you need to have at least that much profit available above your starting capital buffer to make a withdrawal request.

Verify these exact amounts on the Apex site as they could potentially adjust them.

7. The Big Trust Question: Are Apex Payouts Legit? (Spoiler: Yes!)

This is probably the most critical question for anyone considering Apex or any prop firm. Are Apex payouts legit? Can you actually get paid?

The short answer is a resounding YES. Apex Trader Funding has established itself as one of the leading prop firms, and a huge part of their reputation relies on reliably paying out successful traders using their current systems (ACH and Rise).

Addressing the Skepticism

It's natural to be skeptical. The prop firm industry has seen some less reputable players, and the idea of trading someone else's large capital pool and keeping most of the profits sounds almost too good to be true. However, Apex's business model is sustainable: they make money from the evaluation fees (especially during those big sales!) and their 10% share of profits (after the initial $25k). They need successful traders to make their model work long-term. Paying out consistently is essential for attracting new traders and maintaining their reputation.

Apex's Own Payout Dashboard: Transparency FTW!

One of the strongest pieces of evidence for Apex's legitimacy is their public payout dashboard. You can find it right on their website: https://apextraderfunding.com/payouts

This dashboard shows:

-

The total amount paid out to traders (often running into the tens or even hundreds of millions of dollars).

-

A live feed of recent payouts, often showing the amount and sometimes the trader's initials or a masked identifier.

Seeing this transparency, with constantly updating figures showing significant sums being paid out regularly, provides strong social proof.

Community Buzz

Spend some time in trading communities (like Reddit forums, Discord servers, Facebook groups) dedicated to prop firms. You'll find numerous discussions about Apex payouts. While you might occasionally see someone complaining (often due to misunderstanding a rule or issues setting up their new payout method), the overwhelming sentiment is positive regarding Apex actually paying out when the rules are followed.

8. Account Juggling: How Many Accounts Can You Have on Apex Trader Funding?

Apex is known for being quite flexible with the number of accounts a single trader can have.

The 20-Account Max

Currently, Apex allows traders to have up to 20 PA (funded) accounts simultaneously under one membership. This is a significant number compared to some other firms.

Payouts Across Multiple Accounts

Having multiple accounts impacts payouts in a few ways:

-

Evaluation Fees: You pay evaluation fees for each account separately (though sales help!).

-

Trading Rules: Each account is treated independently regarding rules like drawdown.

-

Payout Eligibility: Each account must individually meet the payout eligibility criteria.

-

Combined 100% Threshold: The initial $25,000 paid out at 100% is per member, cumulative across all accounts.

-

Payout Requests: You can request payouts from multiple eligible accounts during the same payout cycle.

The multi-account policy allows traders to diversify strategies, scale potential profits, and leverage the different account sizes Apex offers.

9. The Rule Everyone Asks About: What is the 30% Rule on Apex Payout? (Updated Rationale)

This rule, often called the "consistency rule," causes the most confusion regarding Apex payouts. Let's break down the typical 30% rule:

Decoding the Consistency Rule

The rule essentially states: No single trading day's profit can account for more than 30% of the total profit being considered for your payout request.

When you request a payout, Apex checks the profit required to reach that payout level. They verify if any single day's P&L contributed more than 30% of that specific profit amount.

Why Does It Exist? (Filtering Luck vs. Skill)

Apex wants to fund consistent traders, not just "whimsy get lucky traders" who enter without solid trading logic hoping for a fortunate break on a news event or a single massive gamble. This rule is specifically designed to filter out inconsistent results that might stem from luck rather than skill. It encourages:

-

Real Strategy: It forces traders to demonstrate a repeatable edge that generates profits over multiple days, not just one fluke.

-

Risk Management: It discourages taking excessively large, unjustified risks hoping for that one giant winning day.

-

Long-Term Partners: Consistent traders are more likely to be profitable long-term, making them better partners for Apex's funding model. They want traders who can reliably extract profits from the market.

A Simple Example

Let's say you're on a $50k account (starts at $50,000).

You grow it to $53,000. Total profit = $3,000.

You want to request a payout.

Apex checks how you made that $3,000:

-

Scenario 1 (Passes): Profits spread out: Day 1: +

500, Day 3: -700,Day2:+

800, Day 5: +200,Day4:+

600. Best day = $800. 30% of $3,000 = $900. Since $800 < $900, you pass.600,Day6:+ -

Scenario 2 (Fails, potentially): One huge day: Day 1: +$1500, then smaller days add up to $3,000 total. Best day = $1500. 30% of $3,000 = $900. Since $1500 > $900, this day represents too large a portion of the profit.

What happens if you "fail"? It usually means your payout might be limited, or you need to generate more total profit so that the big day represents less than 30% of the new, higher total profit before withdrawing the full amount. Check your dashboard for stats on this.

10. Tips for Smooth Sailing: Getting Your Apex Payouts Without a Hitch

Want to make sure your Apex Trader Funding payout process goes smoothly? Here are some tips:

-

Read the Rules (Seriously!): Understand ALL rules, especially payouts, drawdown, and the 30% rule. Check their FAQ.

-

Know the Dates: Track payout request windows and processing timelines.

-

Set Up Your Payout Method CORRECTLY: Follow Apex's instructions for ACH (US) or Rise (International) immediately when eligible. Double-check details.

-

Understand the 30% Rule: Monitor your daily P&L vs. total profit. Aim for steady gains.

-

Double-Check Your Request: Correct amount, correct account(s).

-

Be Patient: Remember the processing (5-7 business days) plus bank/Rise transfer time.

-

Keep Records: Save confirmations, track payouts.

-

Trade Consistently: Focus on strategy and risk. Avoid gambling.

-

Factor in Buffer: Leave room above your drawdown level after withdrawal.

-

Contact Support (Appropriately): Use Apex support for Apex issues, Rise support for Rise issues. Be polite and clear.

11. The Bottom Line: Is Getting Paid by Apex Realistic?

Absolutely. Getting your Apex payouts via ACH or Rise is the norm for successful traders following the rules. Apex Trader Funding has built a reputation on providing opportunities (with great sales and account sizes) and, crucially, paying out profits according to their terms.

The key remains understanding and respecting the rules. The requirements like minimum trading days, the 30% consistency rule (designed to weed out luck), and drawdown limits filter for disciplined traders with a real edge. If you can navigate the evaluation and trade profitably within their framework, you can realistically expect to receive your Apex trading payout.

The generous 90/10 split, the initial 100% payout up to $25k, and the multi-account options make Apex attractive. Just remember that trading involves risk, requires skill, discipline, and a consistent strategy – not just hope or luck.

So, if you're considering Apex or already trading with them, focus on honing your skills, managing risk, setting up your payout method correctly, understanding the rules, and the Apex Trader Funding payouts can certainly become a regular part of your trading journey. Good luck!