Table of Contents

-

Introduction: The Quest for an Edge in Futures Trading

-

The Appeal and Challenge of Futures Markets

-

Introducing ICT as a Potential Framework

-

-

Decoding ICT: What Does It Stand For and What Is It?

-

ICT: The Inner Circle Trader Explained

-

Beyond Technical Analysis: The Core Philosophy of ICT

-

Understanding Market Makers and "Smart Money"

-

-

Core Concepts of the ICT Trading Strategy

-

Liquidity: The Fuel of the Market

-

External Range Liquidity (Buy-side/Sell-side)

-

Internal Range Liquidity (Imbalances/FVGs)

-

-

Market Structure: Reading the Narrative

-

Break of Structure (BOS)

-

Change of Character (CHoCH)

-

-

Order Blocks (OB): Footprints of Institutional Activity

-

Fair Value Gaps (FVG) / Imbalances: Magnets for Price

-

Premium and Discount Zones: Where to Look for Entries

-

Optimal Trade Entry (OTE): High-Probability Setups

-

-

Can You Trade Futures Using the ICT Strategy? (Spoiler: Yes!)

-

Why Futures Markets are Ideal for ICT Concepts

-

High Liquidity and Volume

-

Centralized Exchanges and Transparency

-

Volatility and Price Swings

-

Leverage (A Double-Edged Sword)

-

-

Applying ICT Concepts Directly to Futures Charts (ES, NQ, CL, etc.)

-

Identifying Liquidity Pools on Futures Contracts

-

Spotting Order Blocks and FVGs on Key Timeframes

-

Utilizing Premium/Discount in Futures Price Ranges

-

-

-

Practical Application: An ICT Futures Trading Approach

-

Top-Down Analysis: Setting the Directional Bias (Daily, 4H, 1H)

-

Lower Timeframe Execution: Pinpointing Entries (15m, 5m, 1m)

-

Example ICT Futures Trade Setup (Conceptual)

-

The Importance of Confluence

-

-

Risk Management and Psychology in ICT Futures Trading

-

ICT is Not a Holy Grail: Risk is Always Present

-

Defining Your Risk Per Trade

-

Stop Loss Placement Strategies (Using Structure and Liquidity)

-

The Psychological Demands: Patience and Discipline

-

-

Funding Considerations: Prop Firms and ICT Futures Trading

-

Bridging the Capital Gap with Prop Firms (Featuring Apex Trader Funding)

-

-

Building Your ICT Futures Trading Plan

-

Essential Components of a Robust Plan

-

Market Selection (Focusing on Specific Futures Contracts)

-

Timeframe Combination

-

Entry and Exit Criteria (Based on ICT Concepts)

-

Risk Management Rules

-

Record Keeping and Journaling

-

-

Common Challenges and Pitfalls for ICT Futures Traders

-

Over-Complication of Concepts

-

Analysis Paralysis

-

Ignoring Higher Timeframe Bias

-

Impatience and FOMO (Fear Of Missing Out)

-

Neglecting Risk Management

-

-

Conclusion: Embracing Precision and Discipline in ICT Futures Trading

-

Recap: The Power and Potential of ICT in Futures

-

The Journey of Mastery: Learning and Adaptation

-

Final Thoughts on Funding and Success

-

1. Introduction: The Quest for an Edge in Futures Trading

-

The Appeal and Challenge of Futures Markets

Futures trading represents one of the most dynamic and potentially rewarding arenas in the financial world. Offering exposure to indices (like the S&P 500 via ES or Nasdaq 100 via NQ), commodities (Crude Oil - CL, Gold - GC), currencies, and bonds, futures markets attract traders seeking leverage, liquidity, and significant price movement. However, this dynamism comes with inherent challenges. The speed, leverage, and participation of large institutional players mean that retail traders often find themselves struggling to find a consistent edge. Standard technical indicators can lag, traditional chart patterns can fail, and the sheer volatility can lead to substantial losses if not managed correctly. This constant search for a more profound understanding of market mechanics drives traders to explore alternative methodologies.

Spoiler - Don't trade your capital use Apex....

-

Introducing ICT as a Potential Framework

Enter ICT – a trading methodology that has gained significant traction, particularly within the online trading community. Unlike conventional technical analysis that primarily focuses on patterns and indicators as predictive tools, ICT attempts to decode the underlying logic of price movement. It posits that market movements are not random but are engineered by large institutions ("Smart Money") to facilitate their large orders. By understanding the concepts behind this engineering, ICT proponents believe they can align their trades with institutional intent, thereby increasing their probability of success. This article delves deep into the world of ICT Futures Trading, exploring its core tenets, its applicability to the fast-paced futures markets, and the practical considerations for aspiring traders, including funding options.

2. Decoding ICT: What Does It Stand For and What Is It?

-

ICT: The Inner Circle Trader Explained

ICT stands for Inner Circle Trader. This is the moniker of Michael J. Huddleston, the individual who developed and teaches these concepts. ICT is not a single indicator or a rigid system but rather a comprehensive methodology and a collection of concepts based on Huddleston's interpretation of institutional order flow and market manipulation dynamics. The teachings are often disseminated through online mentorships, videos, and community forums. It's crucial to understand that ICT is the name of the teacher/source and the methodology itself.

-

Beyond Technical Analysis: The Core Philosophy of ICT

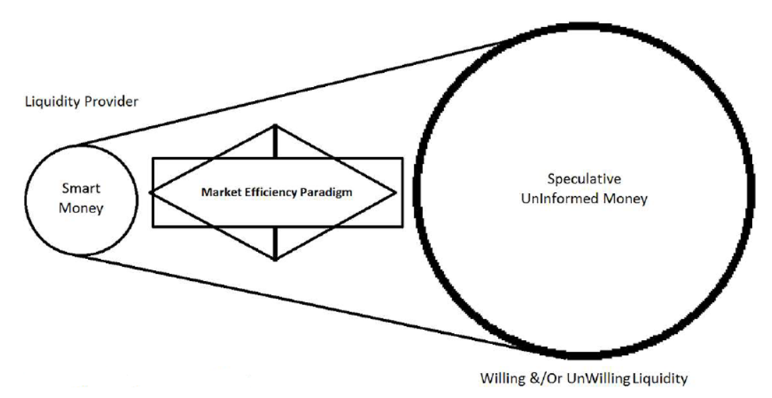

The fundamental premise of ICT diverges significantly from standard retail trading logic. While traditional technical analysis might focus on trendlines, moving averages, or RSI divergences as signals in themselves, ICT views these elements differently. ICT suggests that many commonly taught technical patterns are often used by "Smart Money" to induce retail traders into taking positions, thereby creating liquidity pools that the institutions can then exploit.

The core philosophy revolves around the idea that markets are driven by an algorithm – often referred to as the Interbank Price Delivery Algorithm (IPDA) – which seeks liquidity and aims to rebalance price inefficiencies. ICT traders aim to identify the "footprints" left by Smart Money as they execute their large orders, anticipating where price is likely to move next based on this institutional activity.

-

Understanding Market Makers and "Smart Money"

In the ICT framework, "Smart Money" refers to large financial institutions, banks, hedge funds, and market makers – entities with the capital and influence to move markets significantly. ICT posits that these players don't just react to price; they actively engineer price movements to accumulate positions at favourable levels and distribute them at higher/lower prices. This involves driving price towards areas where stop-loss orders and breakout traders are likely clustered (liquidity pools) before reversing the market in their intended direction. Understanding this alleged manipulation is central to the ICT approach.

3. Core Concepts of the ICT Trading Strategy

ICT encompasses a wide array of interconnected concepts. Here are some of the most fundamental ones:

-

Liquidity: The Fuel of the Market

-

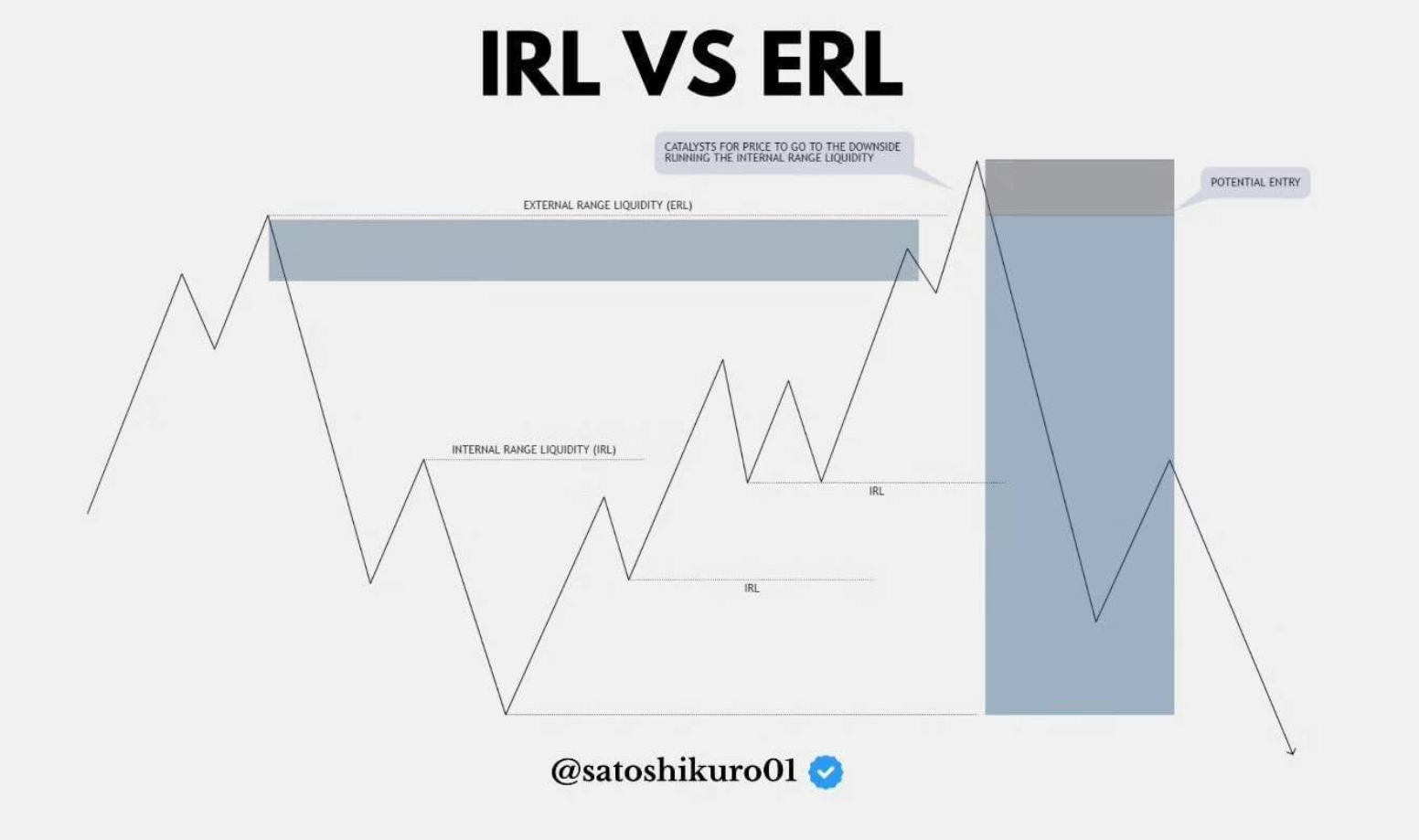

External Range Liquidity (Buy-side/Sell-side): This refers to the pools of orders resting above significant previous highs (buy-side liquidity) and below significant previous lows (sell-side liquidity). ICT teaches that Smart Money often targets these zones to trigger stop losses and find counterparties for their large orders before initiating a significant move in the opposite direction (a "liquidity grab" or "stop hunt").

-

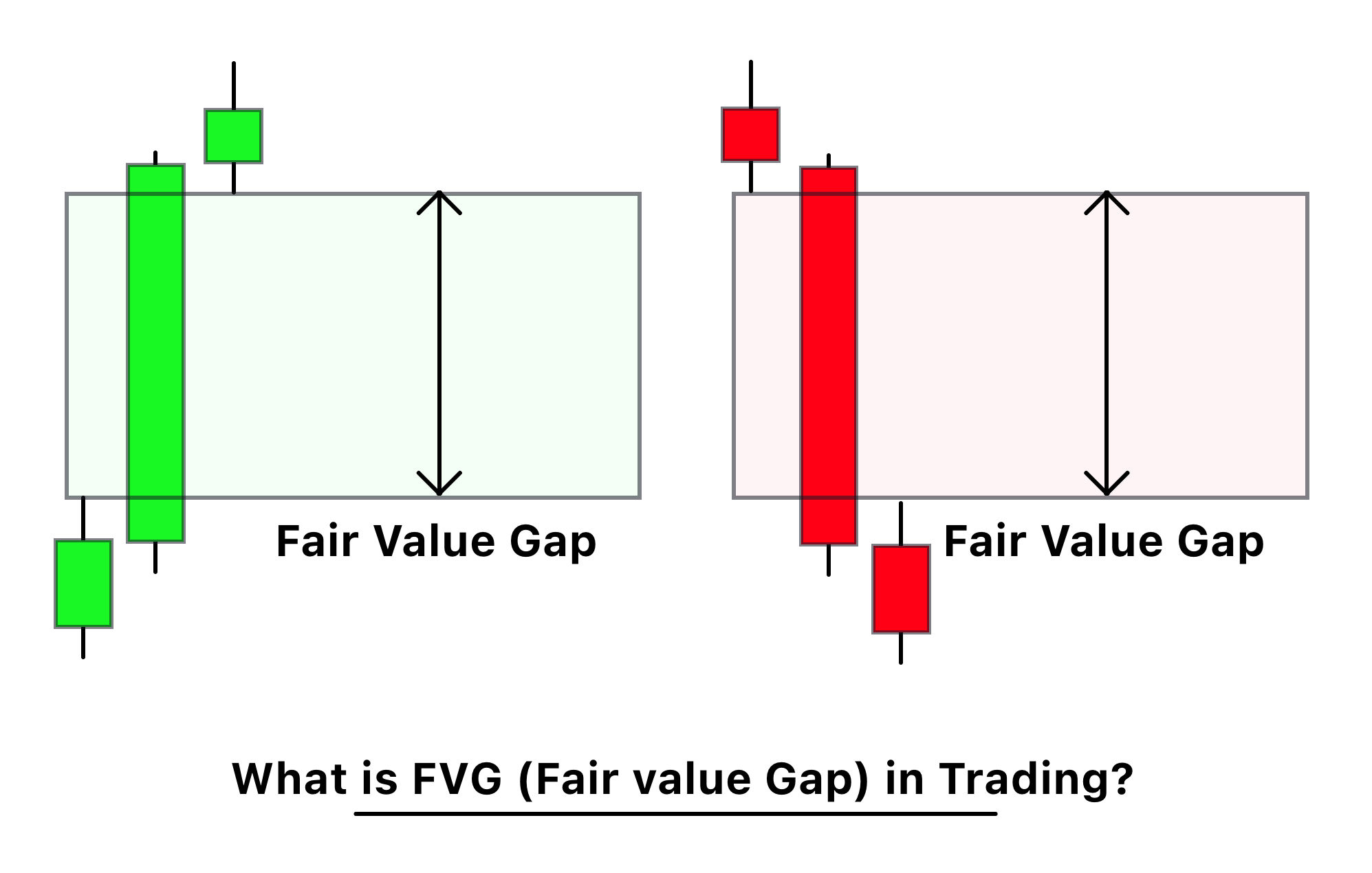

Internal Range Liquidity (Imbalances/FVGs): Within a defined price range, ICT identifies areas of inefficiency where price moved rapidly in one direction, leaving a gap between the candles. These are known as Fair Value Gaps (FVGs) or Imbalances. ICT suggests that price is often drawn back to these areas to "rebalance" the order flow before continuing its trajectory.

-

-

-

Market Structure: Reading the Narrative

-

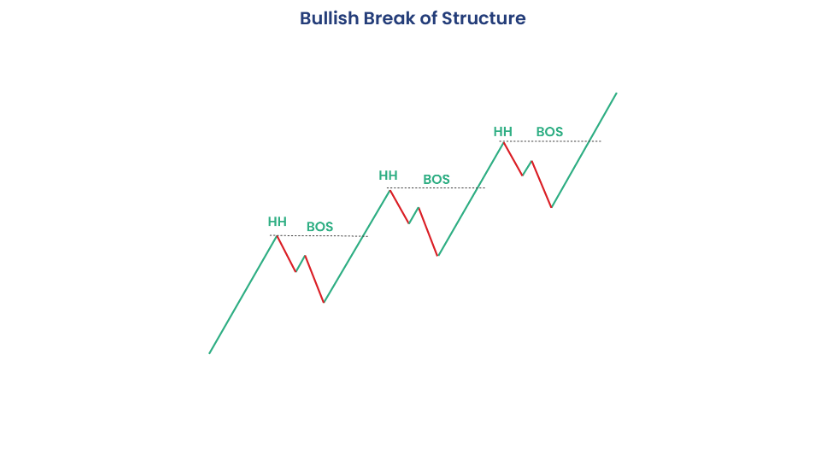

Break of Structure (BOS): When price breaks through a previous swing high in an uptrend or a previous swing low in a downtrend, confirming the continuation of the trend.

-

Change of Character (CHoCH): When price fails to make a higher high in an uptrend and instead breaks a recent swing low (or vice-versa in a downtrend), suggesting a potential reversal or shift in market direction. This is often an early warning sign.

-

-

Order Blocks (OB): Footprints of Institutional Activity

An Order Block is typically defined as the last down-close candle before a strong up-move (bullish OB) or the last up-close candle before a strong down-move (bearish OB). ICT posits that these candles represent areas where Smart Money accumulated or distributed large positions. Price often returns to test these Order Blocks, providing potential high-probability entry zones. -

Fair Value Gaps (FVG) / Imbalances: Magnets for Price

As mentioned under internal liquidity, these are gaps on the chart created by strong, impulsive price moves. They represent inefficiencies in price delivery. ICT traders watch for price to return to fill (or partially fill) these gaps, often finding entries or targets within them. -

Premium and Discount Zones: Where to Look for Entries

Using tools like the Fibonacci retracement (often with specific ICT settings), traders divide a price range (e.g., from a swing low to a swing high) into two zones. The area above the 50% equilibrium level is the Premium zone (where sellers are interested), and the area below is the Discount zone (where buyers are interested). ICT emphasizes looking for buy entries in Discount and sell entries in Premium, aligning with the idea of getting a "good price." -

Optimal Trade Entry (OTE): High-Probability Setups

OTE refers to a specific Fibonacci retracement level (typically between 61.8% and 79%, often focusing on the 70.5% level) within a Discount (for longs) or Premium (for shorts) zone after a significant price swing. It's considered a high-probability entry point when combined with other ICT confluences like market structure shifts and liquidity grabs.

4. Can You Trade Futures Using the ICT Strategy? (Spoiler: Yes!)

Absolutely, yes. The concepts underpinning ICT are arguably particularly well-suited to futures markets.

-

Why Futures Markets are Ideal for ICT Concepts

-

High Liquidity and Volume: Major futures contracts (like ES, NQ, CL) boast enormous daily volume and tight spreads. This high liquidity is precisely what ICT concepts are based on – the need for Smart Money to engineer moves to find counterparties for their massive orders. High liquidity environments provide clearer "footprints."

-

Centralized Exchanges and Transparency: Futures trade on regulated exchanges (like the CME Group), providing transparent volume and price data (Level 2 data can also be insightful for some). This transparency helps in analyzing order flow dynamics, although ICT primarily focuses on price action itself.

-

Volatility and Price Swings: Futures markets often exhibit significant intraday and interday volatility. These swings create the very structures (BOS, CHoCH), liquidity pools, and imbalances (FVGs) that ICT traders look for.

-

Leverage (A Double-Edged Sword): Futures offer substantial leverage, meaning a small amount of capital controls a large contract value. While this magnifies potential profits, it equally magnifies potential losses. ICT's focus on precise entries and defined risk (often using tight stop losses near structural points or OBs) can be synergistic with leveraged trading, but only if risk management is impeccable.

-

-

Applying ICT Concepts Directly to Futures Charts (ES, NQ, CL, etc.)

The beauty of ICT is its fractal nature – the concepts apply across different timeframes and markets.-

Identifying Liquidity Pools on Futures Contracts: Look for clear swing highs and lows on higher timeframes (Daily, 4H, 1H) on charts like the E-mini S&P 500 (ES) or Nasdaq 100 (NQ). These represent major buy-side and sell-side liquidity targets. Intraday highs and lows also create liquidity pools targeted during specific trading sessions (e.g., London session highs/lows, New York session highs/lows).

-

Spotting Order Blocks and FVGs on Key Timeframes: Scan your futures charts (from monthly down to 1-minute, depending on your trading style) for clear Order Blocks that preceded strong moves and Fair Value Gaps left behind. These become points of interest for potential price reactions.

-

Utilizing Premium/Discount in Futures Price Ranges: Define the current operational range on your chosen futures contract (e.g., the range created during the Asian session or the previous day's range). Use the 50% equilibrium level to determine if the price is currently in a Premium (favours shorts) or Discount (favours longs) area, helping filter trade setups.

-

5. Practical Application: An ICT Futures Trading Approach

A common framework for applying ICT to futures involves a multi-timeframe analysis:

-

Top-Down Analysis: Setting the Directional Bias (Daily, 4H, 1H)

Start with higher timeframes (HTF) like the Daily, 4-Hour, and 1-Hour charts. Identify the overall market structure (is it bullish or bearish?), locate key HTF Order Blocks, Fair Value Gaps, and major liquidity pools (e.g., previous weekly highs/lows, monthly highs/lows). This establishes the overarching narrative and potential targets or areas where price is likely drawn. Your bias (long or short) should align with the HTF picture. -

Lower Timeframe Execution: Pinpointing Entries (15m, 5m, 1m)

Once you have a HTF bias and have identified HTF points of interest (POIs), zoom into lower timeframes (LTF) like the 15-minute, 5-minute, or even 1-minute chart as price approaches your HTF POI. Look for LTF confirmations:-

A liquidity grab (price sweeps above a short-term high or below a short-term low into your HTF POI).

-

A Change of Character (CHoCH) on the LTF, indicating a potential reversal against the liquidity grab.

-

The formation of a new LTF Order Block or FVG after the CHoCH.

-

An entry within this new OB/FVG, often aiming for an Optimal Trade Entry (OTE) retracement.

-

-

Example ICT Futures Trade Setup (Conceptual)

-

HTF (e.g., 1H): Identify a bullish trend (higher highs, higher lows). Price pulls back into a 1H Bullish Order Block located in a Discount zone of the recent up-leg.

-

LTF (e.g., 5m): As price enters the 1H OB, observe price sweeping below a short-term 5m low (liquidity grab).

-

Confirmation: Price then rallies strongly, breaking above a recent 5m swing high (a 5m CHoCH, signalling potential reversal upwards). This rally leaves a small 5m FVG or creates a new 5m Bullish OB.

-

Entry: Place a limit order to buy as price retraces back into the 5m FVG/OB, potentially targeting the OTE level within that small retracement.

-

Stop Loss: Place the stop loss just below the 5m low created during the liquidity grab, or below the 1H OB.

-

Target: Aim for HTF targets, such as an old HTF high (external liquidity) or an unfilled HTF FVG (internal liquidity).

-

-

The Importance of Confluence

The most robust ICT setups involve multiple concepts aligning simultaneously. For example, an entry at an OTE level within a Discount zone, that fills an FVG, reacts off a valid Order Block, after a liquidity grab and a market structure shift – this setup has higher perceived probability than one based on a single factor.

6. Risk Management and Psychology in ICT Futures Trading

-

ICT is Not a Holy Grail: Risk is Always Present

It's crucial to dispel any notion that ICT guarantees profits. No trading strategy is foolproof. Losses are an inevitable part of trading. ICT provides a framework for identifying potentially high-probability setups, but market conditions can change, setups can fail, and execution errors can occur. Robust risk management is non-negotiable. -

Defining Your Risk Per Trade

Before entering any trade, know exactly how much capital you are willing to lose if the trade goes against you. This is often expressed as a percentage of your total trading capital (e.g., 0.5%, 1%, or 2% maximum). This must be determined before the trade is placed. -

Stop Loss Placement Strategies (Using Structure and Liquidity)

ICT provides logical places for stop losses. Typically, stops are placed:-

Just below the low of a bullish Order Block (for longs) or just above the high of a bearish Order Block (for shorts).

-

Below the low created during a sell-side liquidity grab (for longs) or above the high created during a buy-side liquidity grab (for shorts).

-

Beyond a significant structural point that would invalidate the trade idea if breached.

-

-

The Psychological Demands: Patience and Discipline

ICT trading often requires immense patience. High-probability setups might not appear frequently. Traders need the discipline to wait for all confluence factors to align according to their plan, rather than forcing trades on suboptimal setups (FOMO). Discipline is also required to adhere strictly to risk management rules, cut losses quickly when invalidated, and not let emotions dictate trading decisions.

7. Funding Considerations: Prop Firms and ICT Futures Trading

-

Bridging the Capital Gap with Prop Firms (Featuring Apex Trader Funding)

Trading futures effectively, especially implementing precise ICT strategies with appropriate risk management, often requires significant capital that can be a barrier for many individuals. Proprietary trading (prop) firms present a potential solution. These firms allow traders who pass an evaluation (demonstrating consistent profitability and adherence to risk rules like drawdown limits) to trade the company's capital in exchange for a profit split. This model enables traders to leverage ICT concepts on substantial account sizes without risking large amounts of personal capital beyond the evaluation fee. The structured, rule-based environment of prop firms can also reinforce the discipline crucial for ICT trading. If you are not using your own significant capital, exploring prop firms is advisable. Among the various options available, Apex Trader Funding is a well-known firm frequently utilized by futures traders, including those applying ICT principles, due to its evaluation models and access to relevant futures markets. As with any financial arrangement, conducting thorough due diligence on Apex Trader Funding or any prop firm, fully understanding their specific rules (especially drawdown), fees, and profit split structures, is essential before engagement.

8. Building Your ICT Futures Trading Plan

A documented trading plan is essential for consistency and discipline. For ICT Futures Trading, it should include:

-

Essential Components of a Robust Plan:

-

Market Selection: Which specific futures contracts will you focus on? (e.g., ES, NQ, CL). Specializing often yields better results.

-

Timeframe Combination: Define your HTF (for bias) and LTF (for execution) combination.

-

Entry Criteria: Exactly which ICT confluence signals must be present for you to enter a trade? (e.g., Liquidity grab + CHoCH + FVG entry in Discount/Premium). Be specific.

-

Exit Criteria: How will you take profits (e.g., targeting specific liquidity levels, HTF FVGs)? Where will your stop loss be placed?

-

Risk Management Rules: Define your risk per trade (%), maximum daily loss, etc.

-

Trading Schedule: When will you trade? (e.g., focusing on London or New York session volatility).

-

Record Keeping and Journaling: Track every trade, including the rationale (with screenshots), outcome, and lessons learned. This is vital for improvement.

-

9. Common Challenges and Pitfalls for ICT Futures Traders

-

Over-Complication of Concepts: ICT has many intricate concepts. Beginners can get lost trying to apply everything at once. Start with the basics (Market Structure, Liquidity, FVGs, OBs) and gradually incorporate more.

-

Analysis Paralysis: Spending too much time analyzing and looking for the "perfect" setup, leading to missed opportunities.

-

Ignoring Higher Timeframe Bias: Taking LTF setups against the dominant HTF trend or narrative often leads to lower probability trades.

-

Impatience and FOMO (Fear Of Missing Out): Jumping into trades that don't fully meet the plan's criteria because of a fear of missing a move.

-

Neglecting Risk Management: Getting overly confident after a few wins and increasing risk inappropriately, or failing to use stop losses consistently.

10. Conclusion: Embracing Precision and Discipline in ICT Futures Trading

ICT Futures Trading offers a compelling framework for traders seeking to understand market mechanics beyond surface-level technical analysis. By focusing on liquidity, market structure, and the perceived actions of Smart Money, ICT provides tools for identifying potentially precise, high-probability entry and exit points in the dynamic futures markets.

However, success with ICT, as with any trading methodology, is not guaranteed and requires significant dedication. It demands rigorous study, extensive backtesting and forward testing, meticulous planning, and unwavering discipline, particularly in risk management and psychological fortitude. The concepts can be complex, and mastery is a journey, not a destination.

For those navigating the capital requirements of futures, prop firms offer a structured path to accessing larger trading accounts, with firms like Apex Trader Funding being a notable option within the community for those applying concepts like ICT. Thorough research into any such firm remains paramount.

Ultimately, whether using personal capital or prop firm funding, traders who embrace the precision demanded by ICT, combine it with robust risk management, and cultivate the necessary patience and discipline stand the best chance of navigating the challenging but potentially rewarding landscape of futures trading.