How To Overcome Fear Of Loss In Trading

Table of Contents

- Introduction

- What is Fear in Trading?

- The Psychology Behind Fear of Loss

- Common Types of Trading Fears

- Is Fear Good or Bad in Trading?

- Signs Your Fear is Controlling Your Trading

- Practical Strategies to Overcome Fear of Loss

- Learning from Successful Traders

- Embracing Losses as Learning Opportunities

- The Evolution of a Fearless Trader

- Conclusion

Introduction

The financial markets can be an emotional rollercoaster, with fear often sitting in the driver's seat. While most trading education focuses on technical analysis, chart patterns, and fundamental research, the psychological aspect is frequently overlooked despite being arguably the most critical component for long-term success.

I've spent two decades in the markets, and I can tell you with certainty: mastering your emotions, particularly fear, is what separates those who survive and thrive from those who burn out and walk away. Fear of loss in trading is perhaps the most pervasive psychological barrier traders face, capable of derailing even the most technically sound trading strategies.

This article delves deep into understanding this fear, its manifestations, and most importantly, how to overcome it to become a more disciplined, consistent, and profitable trader. Whether you're just starting your trading journey or have been in the markets for years but find yourself still battling with emotional trading, these insights will help you transform your relationship with fear and turn it from an adversary into an ally.

What is Fear in Trading?

Fear in trading is a primal emotional response to perceived threats to your financial well-being. It's the knot in your stomach when prices move against your position, the hesitation before entering a trade that meets all your criteria, or the panic that causes you to exit a winning position prematurely.

At its core, trading fear is a biological response. When you perceive a threat to your trading capital, your brain activates the same fight-or-flight response that protected our ancestors from physical dangers. Your amygdala (the emotional center of your brain) takes control, adrenaline pumps through your body, and your prefrontal cortex (responsible for rational decision-making) becomes temporarily impaired.

This biological response was excellent for surviving in the wild but is catastrophic for making calculated financial decisions in the markets. The result? Impulsive, emotional decisions that often contradict your carefully crafted trading plan.

One trader from a popular trading forum described it perfectly: "When fear kicks in, my trading plan goes out the window. I know exactly what I should do, but my emotions override my logic. It's like watching myself make bad decisions in slow motion, powerless to stop it."

Understanding that fear is a natural, biological response is the first step toward managing it. You're not weak or inadequate for experiencing fear; you're human. The goal isn't to eliminate fear entirely but to recognize it, understand its source, and prevent it from dictating your trading decisions.

The Psychology Behind Fear of Loss

The fear of loss in trading goes deeper than just the natural aversion to losing money. It taps into several psychological principles that powerfully influence our decision-making.

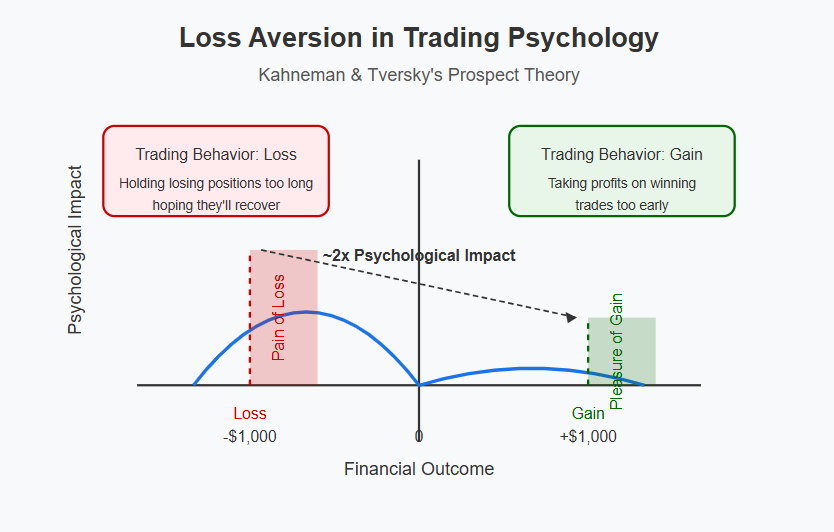

Loss aversion, a concept introduced by psychologists Kahneman and Tversky, demonstrates that the pain of losing is psychologically about twice as powerful as the pleasure of gaining. This means losing $1,000 hurts more than gaining $1,000 feels good. In trading, this manifests as holding onto losing positions too long (hoping they'll recover) while taking profits on winning trades too early.

Another psychological factor is the sunk cost fallacy, where traders continue investing in losing positions because they've already committed time, emotional energy, and capital. "I've already lost 30% on this position; I might as well hold on and see if it recovers" is classic sunk cost thinking.

Confirmation bias also plays a role, as traders selectively interpret information that confirms their existing beliefs while ignoring contradictory evidence. If you're in a long position that's losing money, you might focus exclusively on bullish news while dismissing bearish signals.

These psychological tendencies aren't character flaws; they're hardwired into human cognition. Successful trading requires becoming aware of these tendencies and developing strategies to counteract them.

Common Types of Trading Fears

While fear of loss dominates the trading psychology landscape, several related fears can impact your performance. Understanding these fears is essential for addressing them effectively.

Fear of Missing Out (FOMO)

FOMO drives traders to enter positions impulsively, often at unfavorable prices, simply because they see others profiting. A Reddit user captured this sentiment well: "I watched Bitcoin go from $10,000 to $20,000 without buying in. When it hit $20,000, I couldn't take it anymore and bought with everything I had. Two weeks later, it crashed to $6,000. FOMO destroyed my portfolio."

This fear often leads to chasing markets, buying at the top of bullish trends, or shorting at the bottom of bearish ones. The result is usually entering trades at the worst possible moment, just as smart money is exiting.

Fear of Loss

The central focus of this article, fear of loss manifests in several ways:

- Hesitation to enter trades that meet your criteria

- Moving stop losses too tight, getting stopped out prematurely

- Taking profits too early on winning trades

- Inability to pull the trigger on valid setups

- Reducing position sizes to the point of ineffectiveness

As one trader eloquently put it: "Fear of loss has me trading like I'm already defeated. I take tiny positions because I'm terrified of drawdowns, then watch in agony as my 'practice size' trades would have been huge winners if I'd had the courage to size properly."

Fear of Being Wrong

For many traders, especially those from academic or professional backgrounds where correctness is highly valued, being wrong about market direction feels like a personal failure rather than a normal part of trading.

This fear can cause traders to ignore stop losses, add to losing positions, or refuse to acknowledge when their analysis is incorrect. It transforms trading from a probabilities game to an ego-driven endeavor to prove oneself right.

Fear of Success

Though less discussed, fear of success is real in trading. Some traders subconsciously sabotage themselves when reaching new equity highs because they don't believe they deserve success or worry about the increased responsibility that comes with managing larger sums.

Signs include taking excessive risks after periods of discipline and success, or making uncharacteristic mistakes when approaching significant equity milestones.

Is Fear Good or Bad in Trading?

I like to call myself a fearful trader. I have a constant fear of losing money. This has cost me a lot of opportunities, but highly likely saved me a lot of losses. It has made me survive and evolve for two decades.

The truth about fear in trading is nuanced. Complete fearlessness can be just as destructive as paralyzing fear. The key is productive fear versus destructive fear.

Productive fear serves as a healthy risk governor, keeping you disciplined and preventing you from taking excessive risks. It makes you double-check your analysis, ensures you've considered multiple scenarios, and reminds you to place proper stop losses.

Destructive fear, however, prevents you from executing your trading plan, causes you to second-guess valid setups, and leads to emotional rather than logical decision-making.

Successful traders don't eliminate fear; they channel it productively. They transform fear from an emotion that controls them into a tool that protects them. As legendary trader Paul Tudor Jones said, "I'm always thinking about losing money as opposed to making money."

This healthy respect for risk, rather than paralyzing fear or reckless courage, is the sweet spot for trading psychology.

Signs Your Fear is Controlling Your Trading

How do you know if fear has crossed the line from productive to destructive? Here are some telltale signs:

- Analysis paralysis: You spend hours researching a trade but still can't commit to entering it.

- Premature exits: You regularly take profits well before your predetermined targets.

- Constantly checking positions: You can't step away from your trading screen without anxiety.

- Inconsistent position sizing: Your trade size varies dramatically based on recent results rather than the quality of the setup.

- Relief when losing trades are closed: You feel happier to be out of a trade than sad about the loss, indicating you were trading with too much psychological discomfort.

- Trading plan deviation: You consistently fail to follow your own rules.

- Revenge trading: After a loss, you immediately look for another trade to "get your money back."

If these patterns sound familiar, fear has likely moved from being your ally to being your master. The good news? With conscious effort and the right strategies, you can regain control.

Practical Strategies to Overcome Fear of Loss

Transitioning from theory to practice, let's explore actionable strategies for mastering fear in trading:

Develop a Robust Trading Plan

A comprehensive trading plan serves as your objective guide during emotional turbulence. Your plan should include:

- Specific entry and exit criteria

- Position sizing rules

- Risk parameters per trade

- Daily/weekly/monthly loss limits

- Market conditions when you will and won't trade

A trader from a popular forum shared: "Creating my trading plan was transformative. Before, every decision was emotional. Now, I simply ask, 'What does my plan say?' It removes the burden of making decisions under pressure."

Your plan becomes your trading constitution - the ultimate authority that overrides emotional impulses.

Proper Position Sizing

Fear of loss is often directly proportional to position size. Trading too large creates emotional pressure that few can withstand, while trading too small leads to indifference and lack of discipline.

The classic advice to "reduce size" when facing fear has merit but needs qualification. The goal isn't necessarily to trade smaller but to trade the appropriate size for your psychology and account.

Many professional traders use a position sizing formula that limits each trade's risk to 1-2% of total capital. This approach ensures that no single trade can significantly damage your account, reducing the emotional weight of any individual position.

As your confidence and skill increase, you can gradually increase position size while maintaining the same percentage risk through tighter stop losses or changing market conditions.

Implement Risk Management

Beyond position sizing, comprehensive risk management includes:

- Setting predetermined stop losses before entering trades

- Using options or other hedging strategies when appropriate

- Diversifying across different markets and strategies

- Having clear rules for correlated positions

- Implementing circuit breakers (like stopping trading after three consecutive losses)

These measures create a safety net that allows you to trade with confidence rather than fear, knowing you've protected yourself against catastrophic losses.

Build Confidence Through Knowledge

Fear often stems from uncertainty. The more you understand about markets, your strategy, and historical performance, the more confidence you'll have in your approach.

Continuous education through books, courses, and market study builds a foundation of knowledge that naturally reduces fear. Statistical analysis of your strategy's performance gives you confidence in its edge over a large sample size, making individual losing trades easier to accept as part of the normal distribution.

One particularly effective approach is backtesting - analyzing how your strategy would have performed over historical data. Seeing that your approach would have been profitable over hundreds or thousands of past trades provides powerful psychological reassurance during inevitable losing streaks.

Keep a Trading Journal

A detailed trading journal serves multiple fear-reducing functions:

- Documents your reasoning for each trade

- Provides objective feedback on what works and what doesn't

- Helps identify emotional patterns that affect your trading

- Creates accountability to yourself

- Transforms losses from failures into learning opportunities

Your journal should include not just trade details (entry, exit, size, P/L) but also emotional states, adherence to your plan, and reflections on what you learned.

One trader noted: "Reviewing my journal showed me that 70% of my losses came from trades where I felt FOMO or frustration. That realization alone improved my performance dramatically."

Practice Mindfulness and Emotional Awareness

Developing awareness of your emotional state is crucial for managing fear. Mindfulness techniques help you recognize when fear is influencing your decisions before you act on it.

Simple practices include:

- Taking three deep breaths before executing trades

- Conducting a quick body scan for physical signs of fear (tense muscles, shallow breathing)

- Maintaining a pre-trade checklist that includes "Am I emotionally neutral?"

- Stepping away from screens when emotions are running high

These practices create space between stimulus and response, allowing your rational mind to regain control from your emotional impulses.

Find a Trading Accountability Partner

One powerful yet often overlooked strategy for overcoming trading fear is finding an accountability partner who will hold you responsible for the trades you take. Having someone review your trading decisions creates external pressure to follow your plan and reduces impulsive, fear-based decisions.

An ideal accountability partner is another trader who understands markets but isn't emotionally invested in your trades. You can leverage trading social platforms to find suitable partners. These platforms allow you to connect with traders of similar experience levels, share trade ideas, and review each other's performance objectively. Your accountability partner can question your reasoning when you avoid valid setups due to fear, call you out when you're breaking your own rules, and provide emotional support during inevitable drawdowns.

As one trader shared: "My trading completely transformed after finding an accountability partner. When I know I have to explain my trades to someone else, I'm much less likely to make emotional decisions. It's like having a trading coach without the expensive price tag." This external accountability structure creates a powerful psychological barrier against letting fear control your trading decisions.

Learning from Successful Traders

Studying how successful traders handle fear provides valuable insights:

George Soros famously develops back pain when his market thesis is wrong - he's learned to use this physical signal as an indicator to reconsider his position. Rather than fighting his fear, he uses it as information.

Ray Dalio advocates writing down your investment thesis in detail, then asking trusted colleagues to find flaws in your thinking. This process, which he calls "thoughtful disagreement," reduces fear by ensuring you've considered multiple perspectives.

Jack Schwager, after interviewing dozens of Market Wizards, noted that elite traders "have learned to lose correctly." They view losses as the cost of doing business rather than emotional failures.

The common thread among successful traders isn't fearlessness but fear management. They've developed systems, both psychological and practical, to prevent fear from overriding their trading process.

Embracing Losses as Learning Opportunities

Reframing how you view losses is essential for overcoming fear. As one trader put it: "Losses are not failures; they're tuition payments for your trading education."

Every loss contains valuable information if you're willing to examine it objectively. Was your analysis flawed? Did you violate your rules? Did market conditions change? Each question leads to refinements that improve your approach.

This perspective shift transforms losses from something to fear into something to value - essential feedback that makes you a better trader. When you genuinely believe that losses make you better, they lose much of their emotional sting.

A trader on Reddit shared this perspective: "I used to beat myself up over losses. Now I see them as the market's way of teaching me something I needed to learn. My only real failure is not extracting the lesson."

The Evolution of a Fearless Trader

Overcoming fear of loss isn't a one-time achievement but an evolutionary process. Most traders progress through several stages:

- Unconscious fear - Making fear-based decisions without realizing it

- Conscious fear - Recognizing fear's influence but still struggling to overcome it

- Managed fear - Using systems and practices to trade despite fear

- Integrated fear - Transforming fear into a constructive force that enhances trading

This evolution doesn't happen overnight. It requires consistent practice, self-reflection, and sometimes professional support. Many successful traders work with trading psychologists or coaches to accelerate this development.

The good news is that each step in this evolution brings measurable improvements in both trading performance and quality of life. Trading with less fear is not only more profitable but also more enjoyable.

Conclusion

Fear of loss is an inevitable companion on your trading journey. Rather than trying to eliminate it - an impossible task - focus on understanding, managing, and eventually harnessing it.

By developing a robust trading plan, implementing proper risk management, building knowledge, maintaining a journal, practicing mindfulness, learning from successful traders, and reframing losses as learning opportunities, you can transform your relationship with fear.

Remember that losses are inevitable and part of the process. As one wise trader put it, "You don't have to kill your fear of loss. You just need to stop it from killing your trades."

The ultimate goal isn't to become fearless but to develop a healthy respect for risk that protects rather than paralyzes you. This balanced approach - neither reckless nor timid - is the psychological foundation of sustainable trading success.

Your journey toward mastering fear may be challenging, but it's infinitely rewarding. Each step forward not only improves your trading but develops personal qualities that benefit every area of life: discipline, emotional intelligence, and the courage to act despite uncertainty.

Start today with one small step - perhaps writing your trading plan or keeping a journal. With persistence and self-compassion, you'll gradually transform fear from your greatest trading weakness into one of your greatest strengths.